philadelphia wage tax return

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Philadelphia wage tax calculator Wednesday June 8 2022 Edit.

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

It is customary for me to get a credit on my New Jersey income tax return for the Philadelphia municipal wage taxes I have paid.

. Use this form to file your 2021 Wage Tax. Your first filing due date for 2022 is May 2. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent.

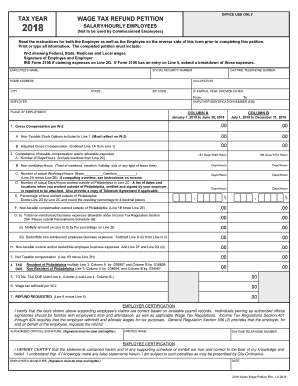

Complete this petition to see if any refund is due. Go to Philadelphia Earnings Tax. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Non-residents who work in Philadelphia must also pay the Wage Tax. Philadelphia Department of Revenue 1401 John F. Non-residents who work in Philadelphia must also pay the Wage Tax.

Payment due dates for 2022 Monthly Wage Tax payments. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. In Line 3 - Include wages from this compensation in preparation of the annual reconciliation of employee earnings tax select the checkbox.

Or your Philadelphia Tax Identification Number PHTIN FILE OR PAY NOW External link. I think its around 3 on top of PA state tax. Philly is a big city though new york has state taxes that are like 6 depending on your income level.

Non-residents who work in Philadelphia must also pay the Wage Tax. The Earnings Tax is a tax on salaries wages commissions and other compensation paid to a person who works or lives in Philadelphia. These are the main income taxes.

In Line 1 - W-2 name use the drop-down and select the appropriate W-2 to link. Forms include supplementary schedules worksheets going back to 2009. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now.

So yeah it def adds up. Who pays the tax. Tobacco and Tobacco-Related Products Tax.

Philadelphia resident with taxable income who doesnt have the City Wage Tax withheld from your paycheck. The City Wage Tax is a tax on salaries wages commissions and other compensation. Use Occupancy Tax returns prior to 2014 must be obtained by 215 686-6600 or emailing revenuephilagov.

Medicare Tax is 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Your Federal Entity Identification Number EIN. These forms help taxpayers file 2021 Wage Tax.

Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax. Solved To file and pay the Earnings Tax by mail use the following address. For more information about these changes please visit the Tax Center Guide.

You must now file and pay this tax electronically on the Philadelphia Tax Center. The Department of Revenue has provided important reminders regarding the new electronic processes for 2022. File Your Income Tax Return And Avoid Paying Heavy.

Or your Social Security Number SSN. See Reconciliation and Schedules below. If the total tax due is less than that withheld by the employer on Forms W-2 the Earnings Tax Return does not need to be filed.

If you work in philly and get wages then you gotta pay philly wage state. Mail the application form to. Philadelphia City Income Taxes to Know.

3 rd quarter filing due date. Sales Use. A non-resident who works in Philadelphia and doesnt have the City Wage Tax withheld from your paycheck.

Instructions for filing an annual reconciliation for 2021 Wage Tax. Individuals who have paid municipal wage tax under these instances will be able to receive a refund from the City of Philadelphia. Philadelphia Wage Tax Withheld on W-2 - The wage tax withheld is pulled from the Form W-2s entered in the federal return if the locality begins with PHI.

The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly. The deadline is weekly monthly semi-monthly or quarterly depending on the. You may qualify for a credit if you paid income or wage tax on the same income in the same year to both New Jersey and to another.

The Wage Tax Refund Petition is not e-filed with the tax return but can be mailed or faxed to the Philadelphia Department of Revenue. Previously Wage Tax filers submitted a reconciliation form once a year. Because of COVID I will be able to work from home for nine months of the year in 2020.

How To File Philadelphia Wage Tax. Philadelphia Department of Revenue 1401 John F. NJ Income Tax Credit for Taxes Paid to Other Jurisdictions.

Philadelphia City Wage Tax should not have been withheld from your paycheck during this time but if it was. A taxpayer who has completed PA Schedule SP for Pennsylvania tax forgiveness may be entitled to a refund of Philadelphia city wage tax withheld by their employer. If you are a New Jersey resident with income from sources outside New Jersey you may be eligible for a credit on your New Jersey tax return.

Ad Find Philly Wage Tax. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Select Section 1 - General Information for Earnings Tax and Wage Tax Petition.

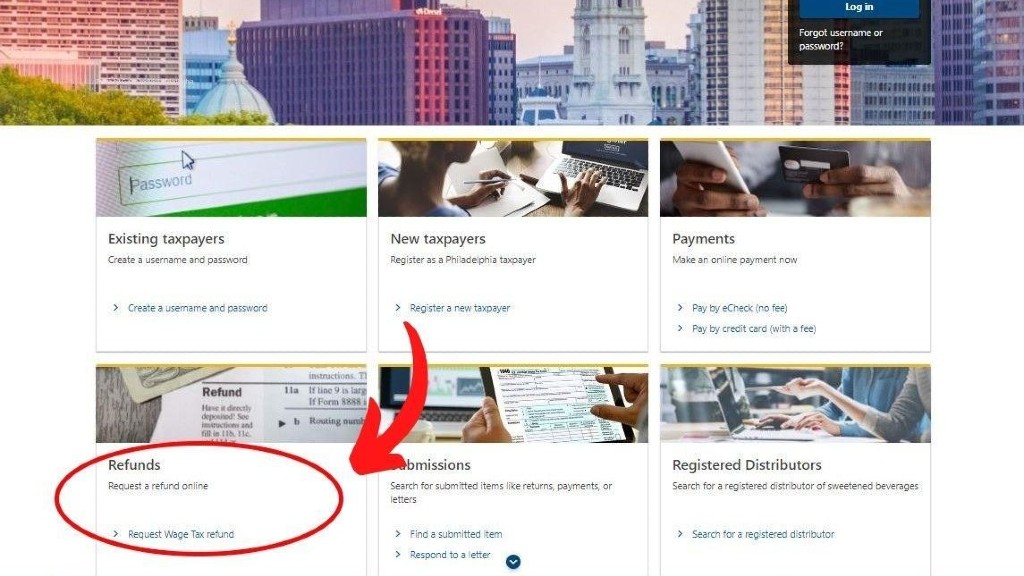

You can also pay Wage Tax online. As of November 2021 The Philadelphia Tax Center is the new website for electronic filing and payment of BIRT NPT SIT Wage Earnings and Tobacco taxes. The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022.

You can also file and pay Wage Tax online. Return to Campus Effective September 2021 the University returned to on-campus work. In an article published on march 2 2021 in the legal intelligencer shareholder jennifer karpchuk explains that for the first time the city of philadelphia department of revenue is allowing employers to file a bulk return on behalf of their employees for 2020 wage tax refunds and.

Tax rate for nonresidents who work in Philadelphia. All Philadelphia residents owe the Wage Tax regardless of where they work. The tax applies to payments that a person receives from an employer in return for work or services.

Download forms and instructions to use when filing City tax returns. File returns and send quarterly payments to. Philadelphia Wage Tax Refund Employer Certification.

Resolve business and incomeWage Tax liens and judgments. As of that time remote work for nonresidents both full and hybrid became subject to Philadelphia City Wage tax unless such remote work. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

![]()

Understanding A Wage Garnishment And How To Stop It Wage Garnishment Wage Payroll Taxes

Cook Reminds Employers Business Owners Of Jan 31 Filing Deadline For Wage Statements Independent Contractor Forms 1099 Http Payroll Tablet How To Find Out

I Ve Been Working My Philadelphia Based Job From Home In The Suburbs Do I Need To Pay Philadelphia Wage Tax Canon Capital Management Group Llc

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Understanding A Wage Garnishment And How To Stop It Wage Garnishment Wage Payroll Taxes

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Digital Signatures Philadelphia Wage Tax Petitions Form Fill Out And Sign Printable Pdf Template Signnow

File Philadelphia Wage Tax Return Quarterly In 2022 Wouch Maloney Cpas Business Advisors

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

How To Get Your Philly Wage Tax Refund Morning Newsletter

Trump Admin Fumbling Medical Equipment Supply Chain Management Rachel Maddow Looks At Report Chain Management Supply Chain Management Emergency Management